Bidding farewell to your GST registration? GSTR-10 is your final dance with the GST regime. Whether you’ve canceled your registration voluntarily or had it canceled, this guide covers everything you need to know about this breakup letter with GST. Let’s make it informative and enjoyable, shall we?

🤔 What Exactly is GSTR-10?

Think of GSTR-10 as your “closing ceremony” with GST. If you’re a registered taxpayer who has canceled or surrendered GST registration, you must file this final return to officially wrap things up. It’s not just paperwork—it’s closure.

📅 GSTR-10 Due Date: When’s the Deadline?

You’ve got three months to file GSTR-10 from the date of cancellation or the cancellation order, whichever comes later. For example: • GST cancellation effective from January 1, 2024 • Cancellation order received on January 5, 2024 • Deadline for filing GSTR-10: April 5, 2024 So, mark your calendars unless you want to add late fees to your farewell gift!

Who Needs to File GSTR-10?

Not everyone gets invited to this final party. GSTR-10 is only for those whose GST registration has been canceled or surrendered. But don’t worry—you’re off the hook if you belong to these groups: • Input Service Distributors (ISD) • Composition scheme taxpayers • Non-Resident Taxable Persons (NRTP) • TDS or TCS deductors under Sections 51 and 52 of the CGST Act

📦 What’s Inside GSTR-10?

GSTR-10 is like a digital time capsule for your business closure. It has 11 sections—some auto-filled, some needing your attention. Auto-Populated Details:

- GSTIN

- Legal Name

- Trade Name (if applicable)

- Address for future correspondence Your Inputs Required:

- Effective Date of Surrender/Cancellation: Mention the date from your cancellation order.

- Reference Number: The unique ID from your cancellation order.

- Date of Cancellation Order: Self-explanatory.

- Details of Closing Stock: Here’s where the fun begins: o Inputs in stock (with invoices) o Inputs in semi-finished or finished goods (with invoices) o Machinery or capital goods in stock o Inputs without invoices (estimated per Rule 44(3))

- Tax Payable & Paid: Reverse that ITC or pay up.

- Interest & Late Fees: Break it down by CGST, SGST, IGST, and Cess.

- Verification: Sign off digitally using DSC or Aadhaar authentication.

📌 Important Notes While Declaring Stock

• No invoices? No problem (kind of). Use market value as per CGST Rule 44(3) and get it certified by a CA or cost accountant. • For machinery, there’s a nifty formula: Invoice value – (1/60th × months since purchase), assuming a 5-year useful life.

🚨 What Happens If You Don’t File GSTR-10?

Procrastination isn’t cute when it comes to compliance. If you miss the due date:

- You’ll receive a notice demanding action within 15 days.

- Still ignoring it? The tax officer will finalize your dues, including penalties and interest. Remember, avoiding GSTR-10 is like skipping the last episode of your favorite show—you’re only leaving things incomplete and messy!

How Does GSTR-10 Differ from GSTR-9?

Here’s a quick analogy: • GSTR-9: Like an annual review—filed by all registered taxpayers. • GSTR-10: Your resignation letter—only for those exiting the GST system.

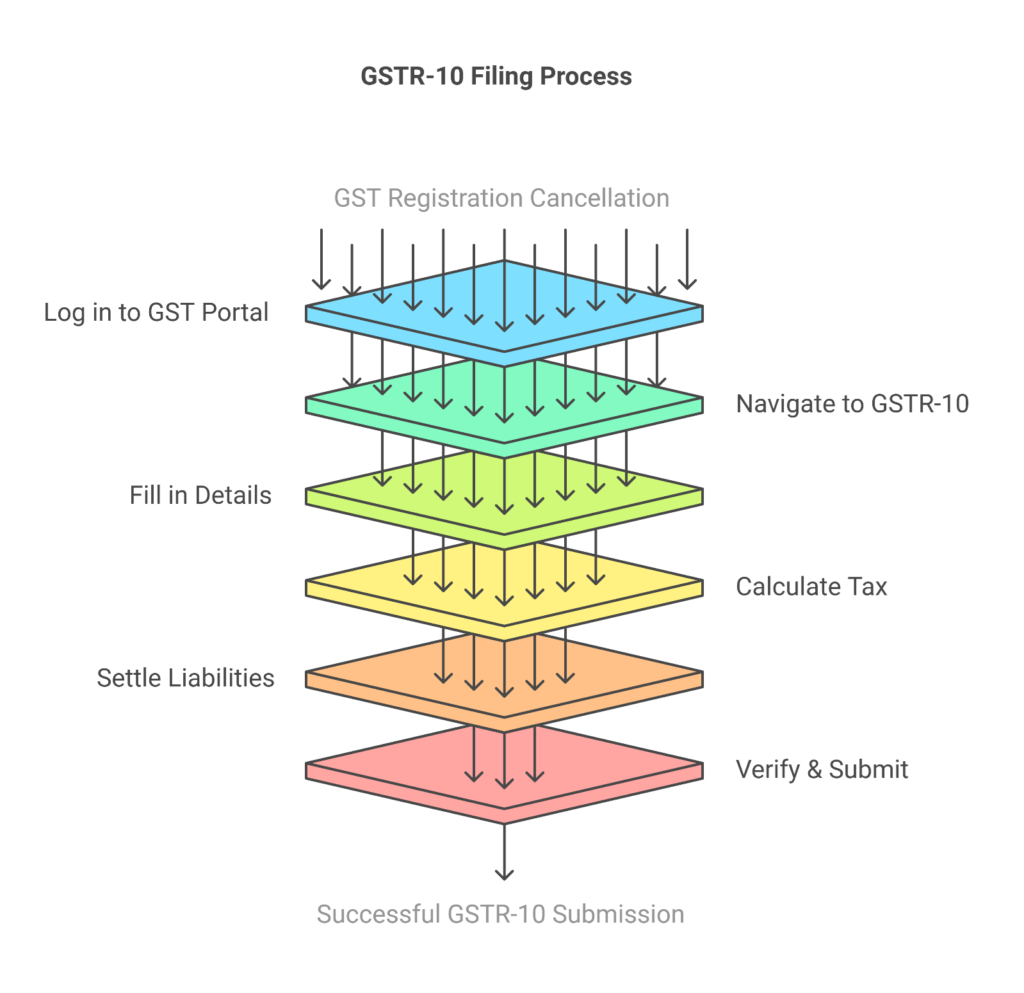

How to File GSTR-10?

Compliance Monk has got your back! Explore our guides on: • How to file GSTR-10 on the GST portal • Steps to file GSTR-10 using the offline tool

Option 1: Filing GSTR-10 on the GST Portal

Follow these simple steps to file your final return directly on the GST portal:

- Log in to the GST Portal o Visit GST Portal. o Use your credentials to log in.

- Navigate to the Return Filing Section o On the dashboard, click Services → Returns → Final Return (GSTR-10).

- Fill in the Required Details o Auto-populated sections: GSTIN, legal name, trade name, etc. o Enter manually: § Date of GST registration cancellation. § Reference number and date of the cancellation order. § Details of closing stock and corresponding input tax credit (ITC).

- Compute and Pay Tax Liability o The system will calculate the tax payable based on the details provided. o Pay any outstanding liabilities through your electronic cash or credit ledger.

- Verify and Submit o Double-check all entries for accuracy. o Use your DSC (Digital Signature Certificate) or Aadhaar-based e-signature to authenticate. o Submit the form and download the acknowledgment for your records.

Option 2: Filing GSTR-10 Using the Offline Tool

If you prefer working offline, here’s the process:

- Download the Offline Tool o Visit the GST Portal and download the GSTR-10 Offline Utility from the Returns section.

- Install and Open the Tool o Extract the downloaded file and open the tool on your system.

- Prepare the GSTR-10 Form o Fill in all the mandatory fields: GSTIN, cancellation order details, closing stock particulars, and tax payable. o Use drop-down menus and pre-validated fields to avoid errors.

- Generate JSON File o Once the form is complete, click Validate to ensure all entries are error-free. o Generate a JSON file to upload to the GST Portal.

- Upload the File to the GST Portal o Log in to the GST Portal. o Navigate to Services → Returns → Upload File. o Upload the JSON file and wait for the system to process it.

- Review, Submit, and Pay o Review the uploaded details on the portal. o Make any necessary payments for outstanding tax liabilities. o Submit the form with a digital signature or Aadhaar-based e-signature.

Why Choose Compliance Monk?

At Compliance Monk, we understand that filing GSTR-10 can feel like an uphill climb. That’s why we’re here to simplify the process with: • Expert guides and walkthroughs. • Real-time support for troubleshooting. • Automated tools to ensure error-free submissions. Visit Compliance Monk today and file your GSTR-10 like a pro—quick, easy, and hassle-free!

💭 Final Thoughts

GSTR-10 isn’t just a form; it’s a statement. It tells the tax authorities, “I’m done here, and I’m doing it right.” Whether you’re closing shop or switching gears, filing this return is crucial for a clean slate. With Compliance Monk by your side, filing GSTR-10 will be as smooth as a perfectly brewed coffee. Let’s get it done and dusted, minus the hassle and late fees!

FAQs on Filing GSTR-10: Final GST Return

1. What is GSTR-10?

GSTR-10 is a final GST return that must be filed by taxpayers whose GST registration has been cancelled or surrendered. It serves as a declaration of liabilities on the closing stock and settles any remaining dues.

2. Who needs to file GSTR-10?

Any registered taxpayer whose GST registration has been cancelled or surrendered must file GSTR-10, except for the following categories:

- Input Service Distributors (ISD)

- Composition scheme taxpayers

- Non-Resident Taxable Persons (NRTP)

- Persons required to deduct TDS under Section 51

- Persons required to collect TCS under Section 52

3. When is the due date to file GSTR-10?

GSTR-10 must be filed within three months from the date of GST registration cancellation or the date of the cancellation order, whichever is later.

For example:

- If cancellation occurred on 1st January 2024 and the cancellation order was issued on 5th January 2024, the due date would be 5th April 2024.

4. What happens if I don’t file GSTR-10 on time?

If you fail to file GSTR-10:

- The GST department will issue a notice, giving you 15 days to complete the filing.

- If you still fail to comply, the officer will finalize the liability along with interest and penalties.

5. What information is required in GSTR-10?

Here’s what you need to provide:

- GSTIN, business name, and address.

- Date and reference number of the cancellation order.

- Details of closing stock, including:

- Inputs, semi-finished goods, finished goods, and capital goods.

- Tax liability and payment details.

- Interest and late fee details, if applicable.

- Verification of all details before submission.

6. How can I file GSTR-10?

You can file GSTR-10 through:

- The GST Portal: Enter all details directly online and submit using a DSC or Aadhaar-based e-signature.

- Offline Tool: Prepare the return using the offline utility, generate a JSON file, and upload it to the GST Portal.

7. What is the penalty for non-compliance?

- Late filing will attract penalties and interest.

- If GSTR-10 is not filed even after receiving notice, the officer will pass a final order determining the tax liability.

8. Can GSTR-10 be revised after filing?

No, once GSTR-10 is filed, it cannot be revised. Ensure all details are accurate before submission.

9. How is the tax on closing stock calculated?

- For stock with invoices: Tax is calculated based on the purchase invoice value.

- For stock without invoices: Tax is calculated based on the market value certified by a Chartered Accountant or Cost Accountant.

- For capital goods: Tax is calculated using a prescribed formula considering a five-year useful life.

10. What is the difference between GSTR-9 and GSTR-10?

- GSTR-9: Annual return filed by all regular taxpayers under GST, summarizing yearly transactions.

- GSTR-10: Final return filed only by taxpayers whose GST registration has been cancelled or surrendered, summarizing liabilities and stock at the time of closure.

11. Can I file GSTR-10 without clearing all liabilities?

No, you must settle all tax liabilities, including interest and penalties, before filing GSTR-10.

12. Why is Compliance Monk the right choice for GSTR-10 filing?

At Compliance Monk, we provide:

- Step-by-step guides for filing online or offline.

- Expert advice to avoid errors.

- Tools and assistance to make your GST filing journey smooth and stress-free!